Hi, I’m new here! About me:

- I direct some portion of my investing towards crypto. Of that pie, some goes to Ethereum staking.

- In early 2023, I considered solo, RP or staking

- Chose RP as a good mix of less risky than solo (SmartNode and support), better returns, opportunity to learn and wanting to help decentralize Ethereum; in that order.

- Created 1x16EB minipool in Mar 2023

- I wasn’t thrilled about the RPL risk but thought “well there’ll be buy pressure from folks needing to keep their nodes topped up”, so it shouldn’t drop too much.

- I topped up the node a few times but then it felt like I was “chasing RPL down” and any returns from the node got eaten up in hardware costs and having to keep chasing RPL. I was spending more on RPL than I was earning.

I think that makes me a “Lisa” – although I can’t remember which proposal gave those personas.

I considered leaving, but I saw enough activity about reworking the tokenomics that it was enough for me to stick around. I trust the community to propose, debate and choose the best outcome. I agree with epineph here – holding RPL is a bet on the future, not on the current tokenomics persisting forever.

With my Lisa hat, what I want to see is:

- Never be in a position to have to “chase RPL down” in price (topping up node). “RPL Rewards for Undercollateralized Nodes” from NodeSet paper achieves this, as does ETH-only nodes.

- Deploy more validators with less RPL and less ETH (in that order). Whether that’s Bond Curves or reduced collateral, I don’t know yet. 70% RPL to ETH ratio (in LEB4s) is not for me. I’m here for the ETH, not the RPL, even if I like RPL. I wouldn’t go to LEB4s without sublinear bonding or reduced RPL collateral.

- Reduce gas if I start investing more (Megapools sounds great)

- I like proposals that reward small NOs and thus decentralization, but that’s less important than the previous two.

- I like proposals like Constellation where I earn more for the same operational overhead.

The great flattening shows “something needs to be done” to attract more folks like me or convince me to go from LEB16s to LEB8/4/2.

I think Valdorff’s proposal could do it, but equally the KISS one in NodeSet would too. Simpler is usually better, especially for smart contracts.

Tokenomics

I’m not an expert on this, but some thoughts after reading NodeSet paper and others here:

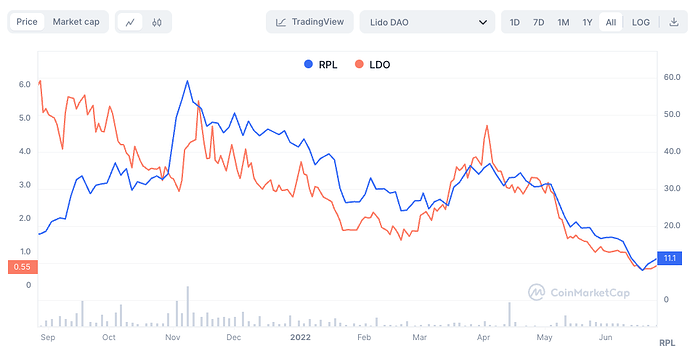

- I doubt RPIP-30 affected the price much. This is crypto. Narrative and macro overwhelms utility. Looking at Lido, the price action was more about the liquid staking narrative IMO. For me, it’s more incentive to buy in order to support a 2xLEB8s vs 1xLEB16, as I know I’ll get proportionally more that overcollaterallized folks.

-

NodeSet’s rationale for the centralizing effect claim of ETH-only nodes and lower bonds are very concerning. Would like to see Valdorff, Samus and others’ thoughts on that.

-

I agree accruing fees to the token risks having it classed as a security, at least in the U.S. That could be a…large distraction.

tldr; Current tokenomics don’t encourage new NOs or existing small NOs to convert to LEB8s, let alone LEB4s. The great flattening supports this. Something needs to change. Do we go big bang per ala SamDorff? Or a more cautious path like NodeSet proposes? Not sure yet. Following with interest.

Thanks everyone for such thoughtful discourse so far!