Hi all,

(A little late) summary below:

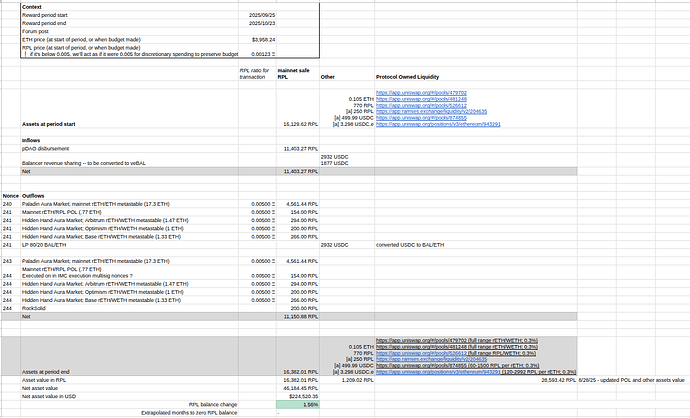

Report 41

- IMC continued spending budget cut (by calculating values with artificial 0.005 RPL/ETH ratio)

- ~11.4k of inflows, ~11.2k of outflows

- Budgeting summary:

- RPL balance change: Period 41 saw a +1.6% change from ~16.13k RPL to ~16.38k RPL.

- The IMC is now spending the previous “extra” unallocated inflows through Paladin to boost liquidity, sticking to the plan of roughly spend the entire inflows each period.

- Balancer continues to send USDC as part of the Balancer Alliance fee share. This is used to grow the v3 position for “LP 80/20 BAL/ETH” (the 2nd fortnight payment wasn’t received until after the tx’s were built so it is tracked in period 42.

- The IMC is contributing to an incentives campaign for RockSolid (200 RPL per fortnight), which began on the second fortnight of Period 41, and will continue at 200 RPL per fortnight for 3 months (1200 RPL total)

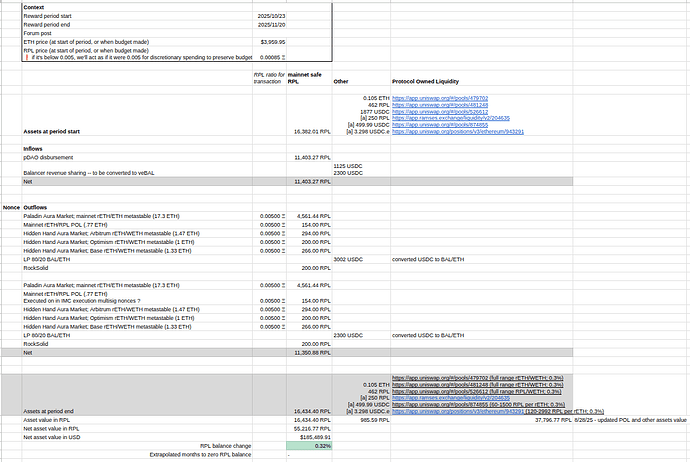

Budget 42

- The IMC is continuing it’s plan to roughly spend the entire inflows each period (further explanation in budget 41 here: IMC Period 40 Report; Period 41 Budget ), with an expected surplus RPL balance of 0.32% this period

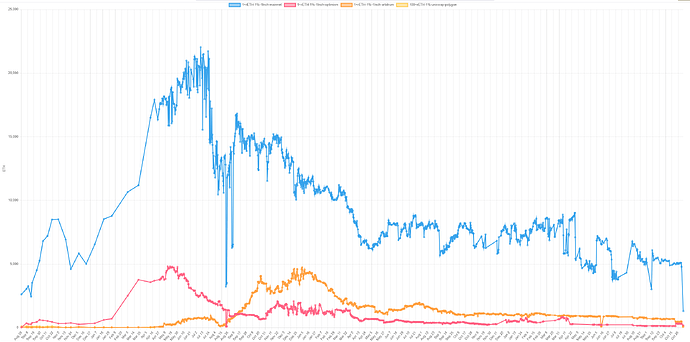

Data - 1% Price Impact

- I noticed the latest data on the website is July 13th, I’ll follow up to see if this can get fixed

Resources

- IMC tracking spreadsheet: IMC tracking - Google Sheets

- IMC RPL tracker: https://dune.com/queries/3209520/5365584

- 1% price impact tracker (assumes RP smart contracts not used): rETH Slippage for IMC