Hello, Rocket Pool!

RPIP-10 says that “the pDAO treasurer SHOULD post an update within one week of the end of each rewards period, which details the following for each category: starting funds, income, spend, final funds.” and I missed the last one so this is going to be a long one. If you just want the TL;DR skip to the last figure.

I spent my first few weeks as treasurer familiarizing myself with the pDAO treasury to make sure I got everything right. So, to make sure the numbers were matching, I built this spreadsheet which was supposed to tell how much should be on each account (GMC, IMC and reserves). Turns out my assumptions of how the protocol works were wrong.

Background (you can probably skip this)

The point of this post is to get everyone that has not been following our governance very closely up to speed on what has been decided and how we have been progressing until now. So the first thing you need to know is that the RPL token has a 5% yearly inflation that is split between Node Operators, oracle DAO (oDAO) and the protocol DAO (pDAO) at 70% / 15% / 15%, respectively. This post only cares about the pDAO funds and they are actually a bit more complicated than just 15% of inflation, as we will see later.

In 2022-08 the pDAO had a governance vote to establish an initial distribution of its funds between: Liquidity incentives (50%), Grants and Bounties (30%), and Reserve Treasury (20%). We also elected two committees (IMC for incentives and GMC for grants) to manage and effectively spend those funds. IMC membership passed a governance vote in August and started spending its budget in September, but members of the GMC have only been elected in October and are now starting their operations.

Why I was wrong about pDAO and it got more than 15% of the inflation

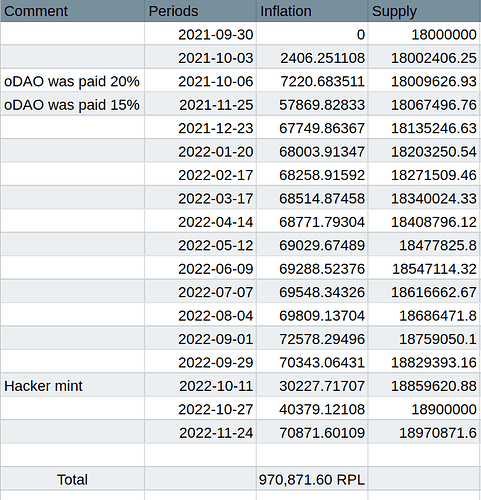

Fig 1 - RPL inflation since launch.

About 970,871 RPL has been minted since launch, so you could expect (as I naively did) pDAO to have 145,630 RPL. Though, if you check our contracts, you will see that we actually got 1,079 RPL more. Valdorff helped figure out that it was a side effect of unclaimed RPL at the end of the rewards period. Since all unclaimed rewards stay at the vault, after inflation is minted the calculation of the pDAO (and oDAO) shares treat inflation and unclaimed rewards the same way.

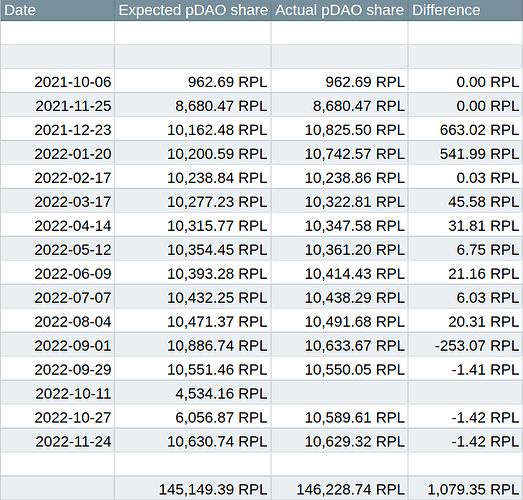

Fig 2 - Expected pDAO column = 15% of the inflation for each period. Actual pDAO share = what was actually paid to pDAO each inflation period.

But this is not all. After the redstone upgrade there are no more unclaimed rewards sitting at the vault and we are still not getting exactly 15% of inflation. We had 3 rewards periods post-redstone and they all paid ~1.41 less RPL (-0.002%) than expected to pDAO and I still have no idea why (maybe it has something to do with solidity math?), hopefully someone here can help me figure it out.

pDAO inflows and outflows

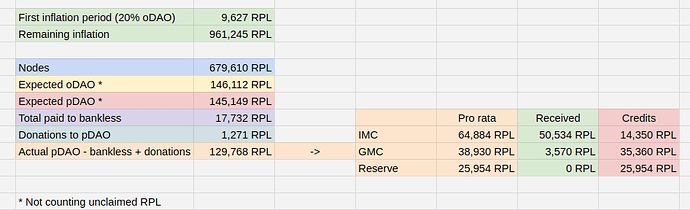

The very first pDAO expense was the bankless campaign, costing us a total of 17,731.62 RPL paid between 2022-06 and 2022-09. Even though this was decided prior to the budget definition, this expense was split between IMC, GMC, and reserves following the default proportion (50% / 30% / 20%).

Besides inflation, pDAO has also received RPL from another source last period with etherscan returning their oDAO rewards from their offline period for a total of 1,270.85 RPL. Both GMC and IMC have received their share of this amount along with inflation disbursements this period.

IMC and GMC payments

The IMC’s multisig wallet has been receiving their inflation share every period since 2022-09-01 and GMC’s has just began receiving theirs this period. Rewards that have accumulated from previous periods amounted 43,046 RPL to IMC and 35,360 RPL for the GMC. IMC accumulated rewards were split in 3 separate payments of 14,348 RPL, 2 of which have already been sent and the last one will be sent next period. Probably a similar disbursement plan will be set up for GMC accumulated reserves.

Fig 3 - pDAO summary with each budget received and credits amount.

What is the scope of the treasurer position

I have not included here the expenditures of IMC and GMC or any analysis on their other sources of income (first period donation from ThomasG for the IMC and POAP event for the GMC, for example). I have taken a look at their transactions, but I think presenting this might be out of scope of my position since each committee has their own treasurer for this, if you disagree I would love to hear your opinion.

Spreadsheets

I have been updating the per-period spreadsheet started by Jasper and Valdorff here:

(RP Treasury Report - Google Sheets)

The spreadsheet with a more global view of the protocol that I made from scratch to figure things out can be accessed here:

(pDAO Treasury Summary - Google Sheets)